Current Mortgage Rates and Homebuyer Assistance Programs in California (December 2025)

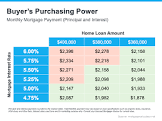

Buyers Purchasing Power

If you’re considering buying your first home in California, understanding current mortgage rates and available assistance programs is key to making a confident move. Here’s a quick, actionable overview for new homeowners as of December 2025.

Current Mortgage Rates (December 2025)

- 30-year fixed-rate mortgage: ~6.33% (Bankrate)

- 15-year fixed-rate mortgage: ~5.80%

- FHA loan rates: Typically slightly lower than conventional, but check with your lender for daily rates (CalHFA FHA Rates).

- CalHFA FHA Standard Rate: 6.00% as of Dec 2, 2025 (CalHFA Rates)

Rates can change daily. For the most accurate quote, consult a CalHFA-approved lender.

CalHFA and State Assistance Programs

CalHFA FHA Loan Program

- FHA-insured, 30-year fixed-rate first mortgage for first-time buyers

- Flexible credit requirements

- Can be combined with down payment assistance

- Learn more: CalHFA FHA Program

MyHome Assistance Program

- Deferred-payment junior loan up to 3.5% of purchase price (FHA) or 3% (conventional)

- Helps with down payment and/or closing costs

- No payments until you sell, refinance, or pay off your first mortgage

- Details: MyHome Assistance Program

Cal Grant and CalHOME Programs

- CalHOME: Grants for first-time homebuyer and rehab assistance (administered via local agencies)

- Cal Grant: Typically education-focused, but California offers a variety of grants and loans for homebuyers. Check CalHFA Homebuyer Programs for the latest options.

FHA Loans: What You Need to Know

- Minimum down payment: 3.5%

- Lower credit score requirements (500+ with larger down payment, 580+ for 3.5%)

- Can be used with CalHFA assistance for even lower upfront costs

- Loan limits vary by county (up to $1,209,750 in high-cost areas)

Next Steps

- Check your eligibility: Use the CalHFA Am I Eligible Tool

- Take a homebuyer education course: Required for most assistance programs (CalHFA Education)

- Connect with a CalHFA-approved lender: Find a Loan Officer

If you have questions about which program is best for your situation or want a referral to a trusted lender, reach out anytime. I’m here to help you make a smart, confident move in today’s market.

Christopher Wall

Knockout Home Luxury | eXp Realty of Southern California