UNLOCKING HOMEOWNERSHIP

🏠 First-Time Homebuyer Assistance Program

Unlocking Homeownership: Long Beach Grants You Should Know About

If you’re looking to buy a home or improve your existing property in Long Beach — or helping clients do so — the city offers several grants and assistance programs designed to make housing more affordable and sustainable. Here’s a breakdown of the key opportunities as of late 2025.

🏠 First-Time Homebuyer Assistance Program

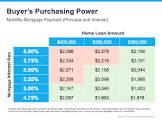

• The city’s First-Time Homebuyer Assistance Program provides eligible applicants with up to $25,000 toward down payment, closing costs, or interest-rate buy-downs.

• The program is not a loan — it’s a grant, meaning recipients do not need to repay the funds.

• Originally limited to certain neighborhoods, the program was expanded in January 2024 to cover all eligible Long Beach residents citywide.

• Grants are allocated to a limited number of households (about 100), so timing and eligibility matter.

This is a major value-add for first-time buyers — a real path toward homeownership in Long Beach, especially considering rising housing costs.

🔧 Home Repair & Improvement: Roof Grants for Homeowners

• The city runs a Home Improvement Roof Grant Program (HIRGP), offering up to $20,000 for eligible homeowners to rehabilitate or replace deteriorated roofs.

• To qualify, homeowners must:

• Own and occupy a single-family home as their primary residence.

• Live in an area designated by the city as part of its Community Development Block Grant (CDBG) zones or other eligible zones.

• Have a household income at or below 50% of area median income (AMI) per HUD guidelines.

• The grant must be applied before starting any construction — it does not reimburse prior work.

For homeowners in older properties needing repairs, this grant can significantly reduce costs and preserve long-term home value.

🛠️ Broader Neighborhood & HUD-Funded Efforts

The city leverages federal funding via U.S. Department of Housing and Urban Development (HUD) grants to support a suite of neighborhood and housing-related initiatives, including:

• Affordable rental housing support

• Neighborhood leadership and resource center funding

• Sidewalk repairs, youth programs, and other community improvements in low-income neighborhoods

These programs typically benefit lower-income residents and help maintain community infrastructure and housing quality over time.

💡 What This Means for Buyers, Sellers & Realtors

As a realtor, being aware of these programs can give you — and your clients — a real advantage:

• For first-time buyers: the $25,000 grant can cover a substantial portion of down payment and closing costs, making homeownership more accessible.

• For homeowners: the roof grant offers a low-cost way to maintain or upgrade a property’s condition — useful for sellers preparing a house for market, or for long-term homeowners investing in their home’s future.

• For investment or rehab clients: HUD-backed neighborhood improvements can help raise long-term property value in affected areas.

✅ Next Steps If You or Your Clients Want to Apply

• Visit the city’s official sites for each program: the First-Time Homebuyer Assistance page, and the Home Improvement Roof Grant Program page. (Search for “Long Beach FTHAP” or “HIRGP” at longbeach.gov)

• Confirm eligibility: income limits, residence status, property type, etc.

• For roof grants: do not start any work before approval — you must wait for the “Notice to Proceed.”

• For homebuyers: ensure you meet first-time buyer criteria, pre-approve for mortgage, and plan to occupy as primary residence.

As property markets remain competitive, these grants can be powerful tools to make homeownership — or home maintenance — more achievable.

Call or email for more information

562.810.0835

chriswall023@gmail.com